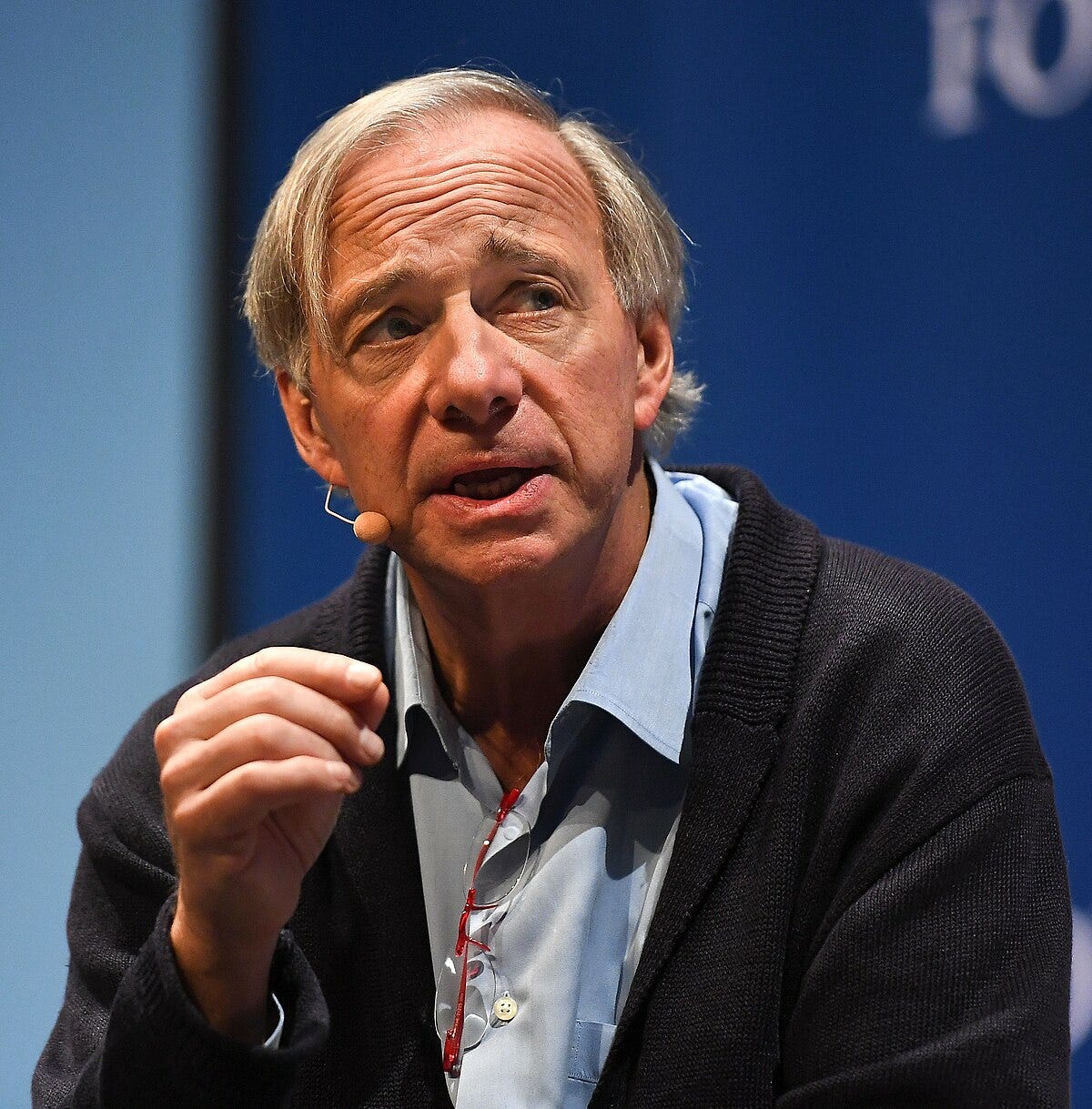

When you think about people who have made a big mark in the world of money, Ray Dalio is a name that often comes up. He is, you know, an American figure, born on August 8, 1949, and he has really shaped a unique way of looking at how the economy works and how to handle investments.

He is the person who started Bridgewater Associates, which, in some respects, grew to be a very large firm that manages money for others. His way of thinking about finances and how things connect has caught the attention of many people, from those who work with money all the way to everyday folks just trying to figure out their own finances. He has a way of breaking down complicated ideas into something a bit more understandable.

Over the years, Ray Dalio has also become known for sharing his thoughts on bigger picture economic trends, offering what he sees as important insights into what might be coming down the road for countries and people. He has, for example, talked quite a bit about debt and what that might mean for everyone's wallets, which is actually something many people worry about.

Table of Contents

- Getting to Know Ray Dalio

- How Did Ray Dalio Build Bridgewater?

- What Guides Ray Dalio's Investment Philosophy?

- Ray Dalio's Economic Warnings

- Why Is Ray Dalio Worried About US Debt?

- What Does Ray Dalio Say About Economic Upheaval?

- Learning from Ray Dalio's Approach

- Ray Dalio's Principles for Life and Business

Getting to Know Ray Dalio

Ray Dalio, a name that resonates in the financial community, has a story that begins like many others, yet his path took him to a place of significant influence. He came into the world in 1949, and from those beginnings, he would eventually shape a very prominent institution. His journey is one that shows how a person can grow a small idea into something truly big, affecting how many people think about money and the economy.

He is known for being the person who started Bridgewater Associates, which, over time, became a very large company dealing with investments. This company, in fact, manages a significant amount of money, something like $112 billion, which is a lot of funds to look after. People who follow the financial scene often look to him for his thoughts on what is happening with money around the globe. He is, to be honest, a very well-known figure, with his personal wealth reaching quite a high number, more than $15 billion, which shows the scale of his success.

Beyond his financial achievements, Ray Dalio has also spent time thinking about and writing down his ideas on how things work, not just in business, but in life generally. He has shared these thoughts, giving people a chance to see the ways he approaches challenges and makes decisions. It's almost as if he has created a guide for how to think about getting things done and how to live your life with a certain kind of clarity.

Here are some basic details about him:

| Detail | Information |

|---|---|

| Full Name | Raymond Thomas Dalio |

| Date of Birth | August 8, 1949 |

| Nationality | American |

| Known For | Founder of Bridgewater Associates, Author, Investor |

| Estimated Net Worth | Exceeding $15 billion |

| Key Publications | "Principles: Life and Work", "Principles for Dealing with the Changing World Order" |

How Did Ray Dalio Build Bridgewater?

The story of Bridgewater Associates, the big investment firm founded by Ray Dalio, is actually pretty interesting, considering where it started and where it ended up. It wasn't, you know, an overnight success without any bumps along the way. In fact, Ray Dalio faced a very difficult period early on, a time when he, more or less, lost everything due to a bad decision with his investments. This kind of setback could make anyone give up, but for him, it seems to have been a turning point.

He used that difficult experience as a chance to really think about what went wrong and how to do things differently. This period, arguably, helped him to shape some of the core ideas that would make Bridgewater what it is today. He started to think about how to be open about problems and how to look at potential risks in a new way. This approach, in a way, helped him to rebuild his firm, making it stronger than before.

His company, Bridgewater, eventually grew into the largest hedge fund in the whole world. This growth wasn't just by chance; it came from a very particular way of doing things. Ray Dalio, you know, became known for promoting what he called "radical transparency," which means being very open and honest about everything, even the difficult stuff. He also helped create a way of managing money called "risk parity," which is about spreading out your investments so that no one thing can cause too much trouble. These ideas helped transform his relatively small beginning into a truly big financial player.

What Guides Ray Dalio's Investment Philosophy?

When you look at how Ray Dalio thinks about investing, it's pretty clear that he has a set of core ideas that shape his every move. He believes that to make good decisions with money, you need to understand the basic reasons behind why things happen in the economy. This is what he means when he talks about his investment philosophy being based on "cause." It's about figuring out the fundamental drivers of economic events, rather than just reacting to what you see on the surface.

His approach, you know, suggests that if you can truly grasp these underlying causes, you can make more informed choices about where to put your money. He has, for example, written a lot about how countries manage their finances, looking at things like debt, income, interest rates, and how much people save. He believes that by carefully looking at these numbers, you can get a good sense of what might happen next, which is a pretty powerful idea for anyone involved with money.

He has also put a lot of thought into how to run a business and how to live your life, capturing these ideas in a series of established "principles." These principles are, in a way, the rules he lives by and the rules he uses to run Bridgewater. They are meant to help people make better decisions and to work together more effectively. It’s almost like a guidebook for success, not just in investing, but in how you approach everything you do. This focus on clear, consistent rules is a big part of what makes Ray Dalio's way of thinking stand out.

Ray Dalio's Economic Warnings

Ray Dalio has, over the years, become quite well-known for his straightforward talk about the economy, especially when he sees things that concern him. He doesn't shy away from pointing out potential problems, even if they are, you know, a bit unsettling to hear. His insights often focus on the bigger picture, looking at trends that could affect everyone, not just those who work in finance. He often shares his thoughts on what he believes are important trends that are shaping the future of money and how countries operate.

He has, for instance, often compared the current economic situation to times in the past, drawing lessons from history to help people understand what might be coming. His aim, it seems, is to give people a clearer picture of the challenges ahead so that they can, perhaps, be better prepared. This willingness to speak openly about potential trouble is a key part of his public persona, making him a voice many people listen to when it comes to economic forecasts.

His warnings are not just general statements; they often come with specific numbers and projections, which can be quite sobering. He tries to provide a clear view of the economic landscape, highlighting areas where he believes there is cause for concern. It’s almost like he is trying to give a heads-up to everyone about what he sees on the horizon, urging people to think about the long-term consequences of current financial choices.

Why Is Ray Dalio Worried About US Debt?

One of the things Ray Dalio talks about quite a bit is the amount of debt the United States has, and he has sounded a real alarm about it. He has, you know, expressed serious concerns that the country's finances are heading towards a very difficult situation. He has pointed out that the US is facing a very large gap between what it spends and what it takes in, something like a $2 trillion deficit, and that it's also paying a huge amount, about $1 trillion, just in interest on its existing debt each year. These numbers, to be honest, are pretty big and can be a bit hard to get your head around.

He has, for example, warned that this growing debt could lead to "big, painful disruptions" for everyone. He believes that if things continue on their current path, the amount of debt each family in the US owes could go up by a lot, maybe as much as 85%, reaching something like $425,000 per family over the next ten years. This kind of increase, you know, could put a lot of pressure on people and the overall economy. He has also linked some of these worries to big government spending plans, suggesting they could make the problem worse.

Ray Dalio has also suggested that the US, while not facing an immediate financial meltdown, is at a very high risk for debt trouble in the longer term. He has urged that quick action is needed to bring down the federal deficit, which is currently around 7% of the country's total economic output. He sees this chronic overspending and the growing $37 trillion debt as something that could, in a way, cause a serious economic problem for America, comparing it to a potential "economic heart attack."

What Does Ray Dalio Say About Economic Upheaval?

Beyond just the debt, Ray Dalio has also spoken about broader economic changes that he believes could cause a lot of trouble. He has, for instance, talked about how big government spending, like certain "big, beautiful bills," could lead to disruptions in the economy. He has suggested that such actions might result in things like cuts to public spending, increases in taxes for people, and even the government printing more money, all of which could have significant consequences for everyone's daily lives.

He has shared his insights on the general trends that are shaping the economy, offering his thoughts on what he sees as the bigger forces at play. His concern is that if these issues aren't addressed, they could have a very deep and unsettling impact on how the global economy works. It's almost like he is looking at the big picture of how countries manage their money and seeing potential cracks in the system that could lead to widespread problems.

Ray Dalio has also written a book about how countries go through big economic cycles and why some of them, in a way, end up in financial difficulty. He believes that by studying these cycles, we can learn how to avoid similar fates. His message is often about the need to understand these large-scale shifts and to be prepared for the changes they bring. He is, in essence, trying to give people a heads-up about what he believes are the major economic challenges that are coming, urging them to think about how these changes might affect them personally and collectively.

Learning from Ray Dalio's Approach

Ray Dalio is not just someone who talks about money; he is also someone who has put a lot of thought into how people can live and work more effectively. He has, you know, shared many of his personal lessons, especially those he learned from making big mistakes. His story includes a time when he lost nearly everything, but instead of giving up, he used that experience to learn and grow. This willingness to be open about his setbacks and what he gained from them is a pretty important part of his public image.

He has often spoken about the importance of being transparent, which means being very clear and honest about what's happening, even when it's difficult. He also emphasizes understanding and managing risks, which is a big part of how he runs his investment firm. These ideas, in a way, are not just for people in finance; they are ways of thinking that can help anyone deal with challenges and make better choices in their own lives. It’s almost like he is saying that failure is not the end, but rather a chance to learn and improve.

His influence goes beyond just managing money. He is considered one of the top voices in the financial world, and he has written books that share his unique perspective. These books are about more than just investments; they offer a deeper look into his way of thinking about how to succeed. He has, for example, talked about how different countries manage their money and what strategies they use, or sometimes fail to use, to stay financially sound. This broad view of how things work is what makes his ideas interesting to many different kinds of people.

Ray Dalio's Principles for Life and Business

One of the most widely known aspects of Ray Dalio's philosophy is his collection of "principles." These are, you know, the established rules or guidelines that he believes anyone can use to make themselves more successful, both in their personal lives and in their work. He put these ideas down in a book, sharing his approach to how he lives and how he manages his company. It's almost like a detailed instruction manual for how to think about problems and make good decisions, which is actually pretty helpful for a lot of people.

He believes that by using these principles, you can improve your decision-making and get better results in whatever you do. His company, Bridgewater Associates, is actually run based on these very ideas. This means that everyone who works there tries to follow these guidelines, which helps to create a very particular kind of work environment. It's about having a clear set of beliefs that guide actions, rather than just making things up as you go along.

These principles cover a wide range of topics, from how to deal with disagreements to how to learn from your mistakes. Ray Dalio thinks that if you have a clear way of approaching things, you can avoid a lot of common pitfalls. He has, for example, talked about how using specific measurements – like looking at debt, income, interest rates, savings, and growth – can really help you understand what's happening in the economy and even predict what might come next. This focus on clear, measurable steps is a big part of what makes his principles so practical for many people.

In short, Ray Dalio's journey shows how someone can build a very large financial firm, Bridgewater Associates, by sticking to a clear set of ideas. He has shared his thoughts on economic concerns, particularly about rising US debt and potential disruptions, drawing from his experiences, including a major setback that helped shape his approach to risk and transparency. His writings, like "Principles," offer a look into his belief that everyone can benefit from having a consistent way of thinking about life and work.

Related Resources:

:max_bytes(150000):strip_icc()/GettyImages-849891036-2000-d19322eb048f4c2595580c09104fdf8a.jpg)

Detail Author:

- Name : Prof. Bertha Langosh

- Username : powlowski.roxanne

- Email : yfarrell@gmail.com

- Birthdate : 1990-03-29

- Address : 70975 Braun Oval Suite 872 Port Eunahaven, MT 48485

- Phone : 682-914-6396

- Company : Purdy, Smith and Fahey

- Job : Obstetrician

- Bio : Et corporis ex eum. Illum autem ut sint quae voluptatem distinctio. Hic dolore quia repudiandae. Minima dicta officia eaque perferendis nisi doloribus.

Socials

tiktok:

- url : https://tiktok.com/@jacintocronin

- username : jacintocronin

- bio : Et id perferendis sunt quod voluptatem blanditiis. Cumque quis minus et autem.

- followers : 3866

- following : 1232

facebook:

- url : https://facebook.com/jacinto674

- username : jacinto674

- bio : Ullam dolor et perspiciatis ut consequatur saepe culpa.

- followers : 1318

- following : 1069

linkedin:

- url : https://linkedin.com/in/cronin1986

- username : cronin1986

- bio : Sit corrupti sint aut molestiae sit facilis.

- followers : 4040

- following : 2625